The EV Smart Charging rEVolution: Hybrid Vehicles & Their Peak Growth in View

About The EV Smart Charging rEVolution Column

This month we’re looking into Hybrid Vehicles & Their Peak Growth…

I’m Julian Skidmore, a senior software engineer at ByteSnap Design and helping to develop our EV – electric vehicle – charging solutions.

We’re a progressive embedded consultancy with an interest in EVs going back to 2012 when we designed and supplied EV chargers for the London Olympics. I’ve had a 2016 Renault Zoe EV since 2017 and over 20% of us who drive into work use a BEV [Battery Electric Vehicle].

In this monthly series, we’ll be covering EV innovations and our experiences with EVs. This is particularly from the perspective of EV charging and the charging infrastructure, which we believe is the other half of the EV revolution.

Let’s Talk About Hybrids

Let’s talk about Hybrids – the quasi-EVs that can’t be independently charged. They have been selling better in the UK than BEVs (Battery Electric Vehicles) or PHEVs (Plug-in Hybrid Electric Vehicles) and they’ve been around a decade longer. At ByteSnap, we like to make bold predictions.

In 2018, when PHEVs were outselling BEVs 2:1, we predicted that PHEVs would be outsold by BEVs within a year.

Since mid-2019, BEVs have done just that.

We’ve been thinking about the next thing since late 2019 and now we need to be clear, BEVs will outsell HEVs (Hybrid Electric Vehicles) really soon. Not just BEVs + PHEVs (they already do that), but just BEVs alone. And once that starts to happen HEV sales will increasingly struggle.

Peak HEVs

Why is this important? Because for most of the time (and this is still certainly true from an advertising perspective), hybrid vehicles are marketed as being eye-catching, innovative, ethical and free from any charging infrastructure. HEVs help us to be good, and we want to be good, but they don’t help insofar as truly transforming transport. They’re like a microgravity test flight versus going into orbit.

And credit where credit’s due: Hybrid models marked the first real shift away from traditional ICE vehicles, e.g. petrol engines and diesel vehicles. This opened up people’s imagination to cars that can at least some of the time, drive silently and without pumping out exhaust fumes. Tens of thousands of drivers in the UK jumped on the HEV wagon and used it as a springboard for their full BEV transformation.

To know why this shift is going to happen and why it’ll happen much faster than we might have guessed we need to look at the drivers behind HEVs (and their variants). This is both in the literal (their users) and figurative (their producers) senses.

History of Hybrid Electric Vehicles

Although non-commercial HEV designs had been produced during the 20th century, the modern HEV era began with the Clinton-era PNGV program in late 1993[1], one year after the Rio Earth Summit [2]. At the time, full EVs weren’t commercialisable (though there was growing interest culminating in GM’s EV1). However, in 1997 Toyota set the benchmark by introducing the Prius, a now multi-iteration, flagship model whose current version’s CO2 emissions are about 92g/Km.

HEVs have real engineering advantages in that they can employ a less powerful ICE engine whose efficiency is better optimised for ranges where they’re suited (i.e. because EVs are particularly good at low speeds). They will also use regenerative braking to provide some 100% electrical traction which is simply not possible with fossil fuels as a power source.

The primary problem with HEVs is that the motivations of their producers are in conflict with the motivations of their users. Car manufacturers make them primarily because of political constraints driving lower emissions. They’re inevitably more complex to build than full fossil fuel vehicles. This makes them undesirable from a manufacturing viewpoint and hard to sell on an economical basis. For example, a Yaris Hybrid would only save about £250 per year (10K miles at £1.1/Litre and 58.8mpg vs 45.5mpg). This would take about 10 years to recuperate given the new price difference.

As a result, the primary motivation for buying and driving a hybrid is ethics rather than cost. In the noughties the UK government provided Vehicle Excise Duty incentives for less polluting cars, whereby only Hybrids would qualify for the lowest rate. However, this was nowhere near enough to compensate for the cost of the car; so, the primary incentive remained ethics. Now governments and ethical buyers are moving on, because BEVs are at the ethical cutting edge and are within the means of a wider set of users.

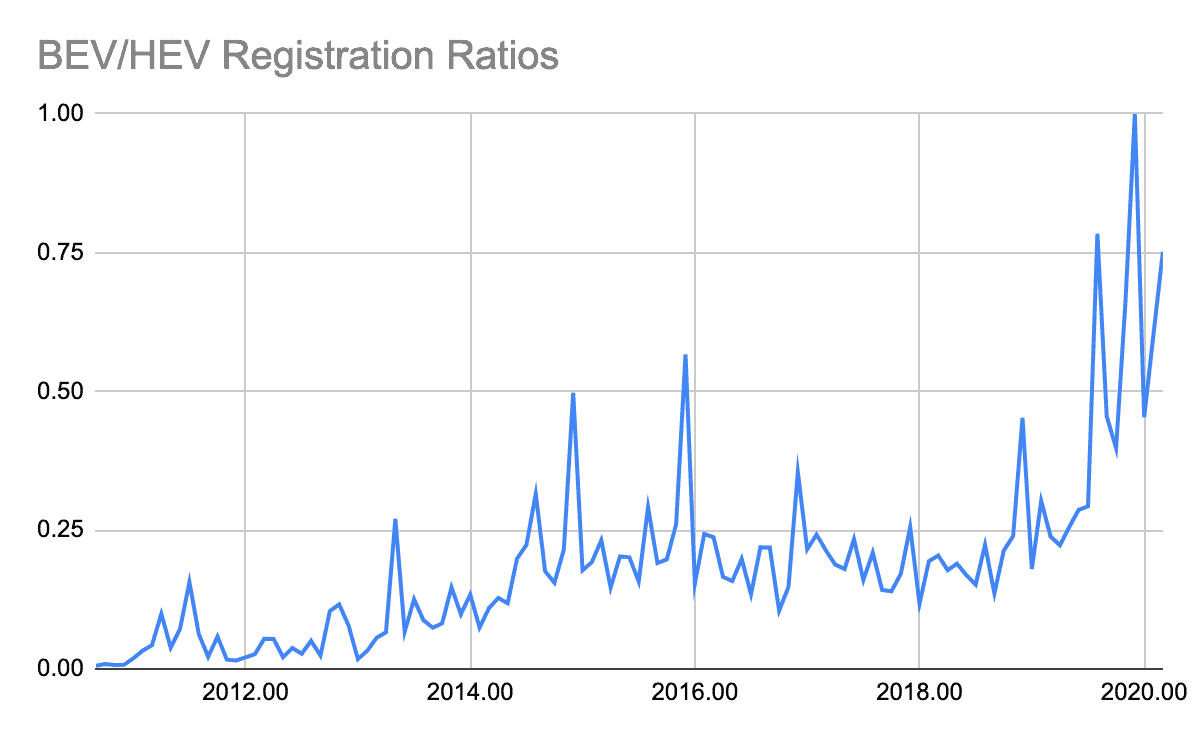

We can see how rapidly the market is changing here. Although the ratio of BEV to HEV is highly variable, due to changes in technology, government policies and available infrastructure; there’s a clear trend over the decade as BEVs catch up. The rapid acceleration from late 2018 meant there’s a high likelihood that for at least one or two months in 2020, BEVs would outsell HEVs in the UK.

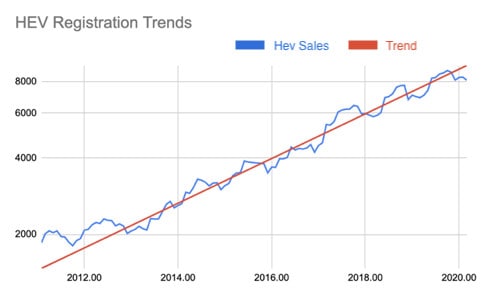

Alongside this, HEV sales themselves are essentially peaking. We can take the same source data; apply a rolling 6-month average (HEVs have predictable 6 month and 12-month registration cycles) we find the following:

The graph is a log graph with the trend line based from 2013 where the growth rate clearly accelerates. We can see that aside from the dip in 2016, Hybrid peak growth happened from 2017 to the beginning of 2019. However, the most telling sign that Hybrids are, or will peak soon is that the April 2020 registrations for Hybrids in the wake of the Coronavirus pandemic, exhibited the greatest fall of all segments, a full 99.3%; while BEV sales were propelled to around 32% of all registrations for that month.

Our internal prediction appears to be already happening, before we published it.

Of course, they will recover in the coming months (excepting any additional lockdowns from further outbreaks), but it reveals an underlying lack of HEV confidence. At the heart of it, BEVs are the disruptive technology that HEVs merely hinted at and as soon as BEVs reach some kind of market parity, attention will rapidly switch.

Car design has been largely incremental since the early 20th century and I think assumes that what motivates people is basically a trade-off between power and price. It’s only partly true. That’s why, for example, the currently lower price of fuel won’t have much of an effect on long-term trends, since most people figure it won’t last. Similarly, the public are starting to price in the obsolescence of fossil fuels and in that context, a HEV is just as obsolete as a full-on petrol or diesel car.

What remains then is the question of how quickly this might happen and what it means for us at ByteSnap. A good indication can be seen in what has happened to the diesel segment, which since the Dieselgate scandal in 2016 has fallen rapidly, in the region of 25% to 30% of sales year on year.

So, it’s more than possible that the HEV market would follow a similar pattern, as it appears, beginning around now. As vehicle trends cascade towards BEV dominance, the pressure will be on to equip us nationally (and globally) and in turn this means a huge amount of work for the embedded software / electronics industry. And that’s part of the reason why we’re expanding to cover product development under the Versinetic brand. We need to be in the vanguard and that’s the only way, for our sake and our customers.

But, What About MHEVs – Mild Hybrid Electric Vehicles?

A ‘new’ category of car has recently appeared on the monthly SMMT vehicle registration reports: the MHEV, or Mild Hybrid Electric Vehicle. These cars provide stop-start functionality for ICE cars and at the top end can assist traction at low speeds. MHEVs are rapidly gaining market share – by about 190% per year, but the technology has been around since the mid-noughties [4].

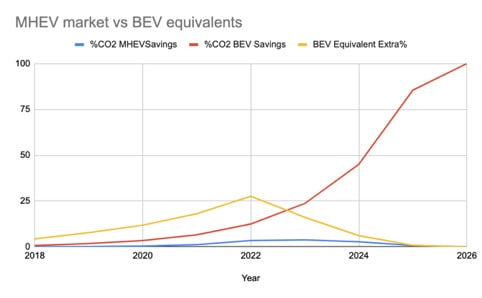

We can make some predictions for them too based on two simple observations: MHEVs improve fuel efficiency by 5% to 10% and (at least at the low end) they work by combining the starter motor and alternator [5]. Assuming that vehicle usage will remain pretty constant between now and 2050 (when transport emissions need to reach zero), then we need to save about 3.3% of emissions per year. But MHEVs can’t achieve that. With current growth rates of MHEVs and BEVs, maximum savings occur in 2022-2023, and this is only equivalent to boosting BEV sales by a maximum of 28% in that year.

Therefore, the following holds: manufacturers will be focussing on securing production capability for BEVs and once they achieve another 5%, they’ll drop MHEVs because it’s not worth the effort of re-engineering all the production lines. In addition, they face little market demand: from an ethical viewpoint, literally no-one goes to a car showroom and says: “I’m thinking of a hybrid car, but only as mild as possible.” This will leave µHEVs, becoming the default for ICE vehicles in the same way electric starter motors replaced starting handles until all fossil fuel vehicles get phased out.

Conclusion on Hybrids

We all want to be good, but awareness and a number of other factors limit our ability to put intentions into practice.

Hybrid Electric vehicles were the first opportunity car drivers had to realistically take a step in that direction. Because the market for Petrol and Diesel cars is so large, the relatively small number who can do that have been easily able to outnumber plug-in electric cars especially given their 10-year head start.

Until now.

Disruptive technology like pure electric vehicles overtakes our ability to manage or predict the future, because the new technology embodies multiple forces that converge to address a number of needs or desires the old couldn’t adapt to. Consider how mobile phones rapidly replaced landline communications because they addressed more needs and which in turn were effectively marginalised by smartphones a mere decade later.

In this case, pure electrical vehicles help tackle not only our imminent environmental needs, but also provide far more scope to re-imagine transport and energy. Right now, BEVs are capturing the imagination of people who would buy a HEV – so that market will rapidly be eaten up before the ICE market itself will, but as the rEVolution accelerates we’ll find the versatility, relative simplicity and stunning improvements of real EVs will capture these other markets even as they’re radically transformed.

Which is to say the demise of Hybrids means that if we’re trying to be good, it’s going to get easier; and why ByteSnap is stepping up to meet the demands that will follow; even in the middle of a global crisis

Reference Links:

[1] https://en.wikipedia.org/wiki/Partnership_for_a_New_Generation_of_Vehicles

[2] https://en.wikipedia.org/wiki/Earth_Summit

[3] https://www.smmt.co.uk/news-search/?_sft_category=evs-afvs

[4] https://en.wikipedia.org/wiki/Mild_hybrid

[5] https://www.sciencedirect.com/science/article/pii/S235248471930592X

How can ByteSnap help you today?

From start-ups to blue chips, ByteSnap’s embedded systems software developers are enabling companies to stay a step ahead by providing them with bespoke solutions. Maintain your competitive edge – contact us today and let your business be among them!